“Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1.”

– Warren Buffett

The simplest and most profound rule of investing is do not lose money. And yet, most investors have a hard time doing just that.

Why is preserving capital so important?

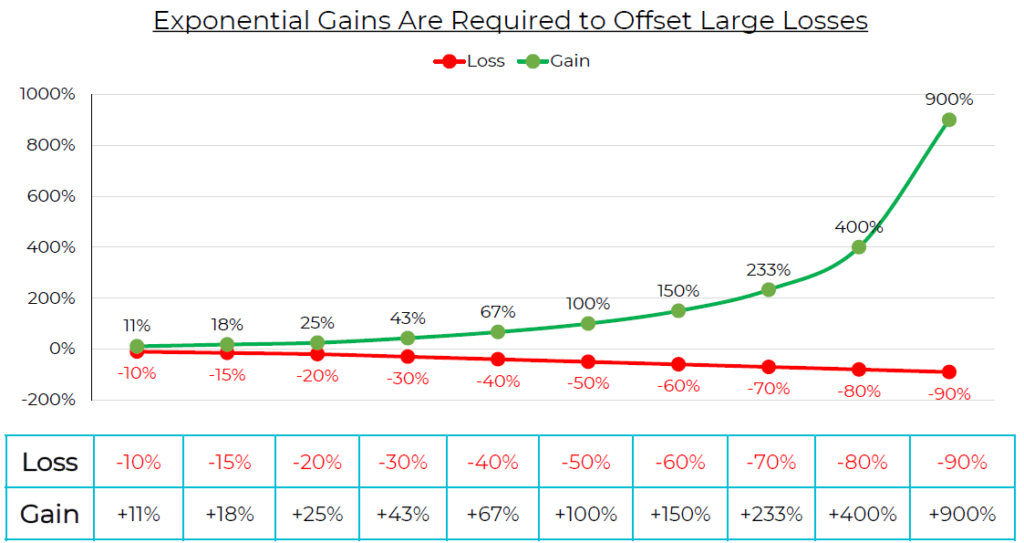

Exponential gains are required to offset large losses. For example, after a 50% loss, a 100% gain is required get back to even.

Source: Two Sevens Capital

Why is it so hard to preserve capital?

To put it simply, investors tend to act irrationally because they suffer from impairments in their decision making. There are many reasons for this. An emerging branch of economics called behavioural finance studies exactly these problems.

On anomaly in behavioural finance discovered in the 1980s is the Disposition Effect. This type of investment behavior makes preserving capital very difficult.

What is the Disposition Effect?

It happens when investors keep assets that have dropped in value, while selling assets that have increased in value – a common problem for many investors.

Maybe you have held onto a losing investment in the hopes it will go up again so you can sell it when it breaks-even?

Maybe you have sold your best investments (the ones that have gone up the most) and kept your worst investments (the ones that went down most)?

These are classic examples of the Disposition Effect.

How is this hurting my investing?

Selling your winners to keep (or subsidize) your losers is a harmful investment strategy in the long run. Think about it, eventually the only investments you are likely to have left are losing ones.

How do private alternative investments help?

The increased volatility of the stock market and the speed at which transactions take place creates an environment where investors are more likely to make split second decisions and suffer from the Disposition Effect.

On the flip side, private alternative investments are harder to transact in but are typically less volatile and can offer a smoother and more predictable return experience to investors than stocks. The impact of this is that investors are less likely to be victims of the Disposition Effect and so they have a better chance of preserving their capital.

Wrapping It Up

In the end, the simplest and most profound rule of investing is do not lose money. And yet, most investors have a hard time doing that but private alternative investments offer a potential solution to the problem.

If you found this post helpful, interesting, or insightful please consider sharing it with a friend!