For some assets, an initial decrease in value is not uncommon during the early stages of the investment life-cycle. For one asset class in particular, this part of the investment experience is crucial in producing excess returns to its owners.

Welcome to the world of private equity.

Unlike traditional equity markets, powered by the emotional narrative of necessary positive quarterly returns. Private equity investments take a more prudent approach to returns, accepting ebbs-and-flows of an investment before it’s eventual rise. In fact, there is a term for this exact phenomenon, it is called the J-Curve.

The J-Curve is a term used to represent the “j” shape of the return curve for a typical private equity investment. Its design often resembles a Nike Swoosh logo, or a hockey stick. The shape of the J-Curve is derived by the initial costs necessary to fund a private equity venture. These costs are typically associated with improving the asset, which may cause a drop in the investment value during its early years, before experiencing a steady increase in value as the investment matures.

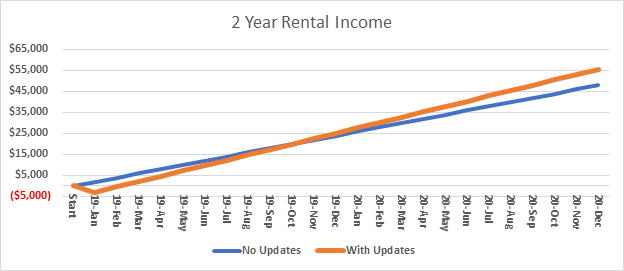

For example, let’s say you and a few friends are interested in purchasing a rental property together. Assume the property is in an excellent location warranting low vacancy expectations. Although, because the property is outdated, you and your friends figure you can only charge $2000 a month in rent. However, if you and your friends decide to spend $5000 dollars in upgrades you can charge an extra $550 dollars monthly in rent.

No Upgrades = $2000 x 12 = $24,000 Income

With Upgrades = $2550 x 12 – $5000 = $25,600 Income

Therefore, by spending some money initially for improvements you and your friends can make an additional $1,600 in your first year, and an extra $6,600 each subsequent year (assuming rent stays the same).

The above is overly simplistic, but it is correct in indicating the point that the J-curve is a powerful benefit to private equity style investments if you’re willing to stick around for the ride.