Across parts of southern Ontario, the residential housing market has been for lack of a better term… on fire. Even in smaller cities and towns where one would expect to purchase a home for its list price, homes are selling for $30k – $100k over asking price. With many employers moving to fully or mostly remote work models, many urban residents are considering purchasing a home outside the of hustle and bustle – pushing house prices to record high levels.

This new market dynamic has created a unique opportunity for many people and given them with new options such as selling, relocating, or downsizing. Although, one option that I hear many individuals considering when downsizing is to repurchase a home without a mortgage and entirely in cash.

At first thought, this idea sounds attractive to many. Who wants to live with a mortgage forever? While there are merits to living mortgage free, many people fail to realize there are more profitable ways to invest the money realized from downsizing if you continue to have a mortgage.

The thing is, borrowing for a house has never been cheaper. Mortgage rates at historic lows ranging anywhere from 1.7% – 2.7%. At the same time, there are many investment solutions out there that distribute cash to investors (this is called yield) on a quarterly or monthly basis of 4% or more. Therefore, placing that excess cash in one of these opportunities may put you further ahead financially than keeping the cash locked up as additional equity in your home.

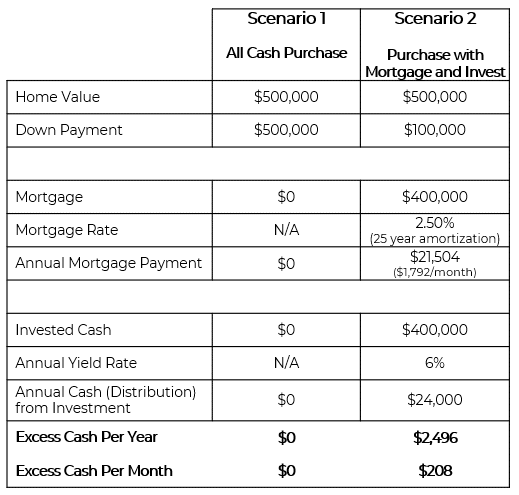

The chart below illustrates the purchase of a $500k home. In scenario one, the homeowner pays $500k cash for the home. In scenario two, instead of paying all cash for the home, the homeowner decides to put $100k down as a down payment and takes out a mortgage for $400k. Now, the homeowner in the second scenario has $400k in excess cash (because they used a mortgage instead of all cash) they could choose to invest. If homeowner two for example invested the $400k into a 6% yielding private equity real estate vehicle they could use the cash generated from the investment to more than cover off all the mortgage expenses, have some additional cash left over, and benefit from the growth of the investment over time.

There are merits to both scenarios each with unique pros and cons to be considered. The purpose of this illustration is to reveal that there are different ways to approaching financial transactions. In the current low interest rate environment, people who are looking to downsize and relocate may have the opportunity to deploy a strategy like the one highlighted above. In my opinion, its a win-win if someone can purchase a home without having to worrying about making mortgage payments and use the mortgage proceeds to make a stable investment that earns income on a monthly or quarterly basis.

If you enjoyed this post please consider sharing it with a friend or colleague!