With the holidays fast approaching, its not hard to be swept away with the gleam and glamour of high-ticket items. Though the underlying message should always be giving instead of receiving, material desires rank among the top of many peoples wish lists.

For many, figuring out how to afford a high-ticket item can be a measure of managing their money or saving a little more to afford that lavish gift for a loved one. A strategy, no doubt passed down from our parents, who always preached “If you want it, you’ll need to save up and buy it”.

Although, this method of purchasing large ticket items has been programmed into our minds from childhood. Sophisticated investors use a different method to acquire the lavish goods they desire such as vacation properties, supercars and private schools. Sophisticated investors know how to acquire such luxuries with seemingly little to no impact on their overall wealth. This draws a natural question…

How do sophisticated investors purchase luxury items?

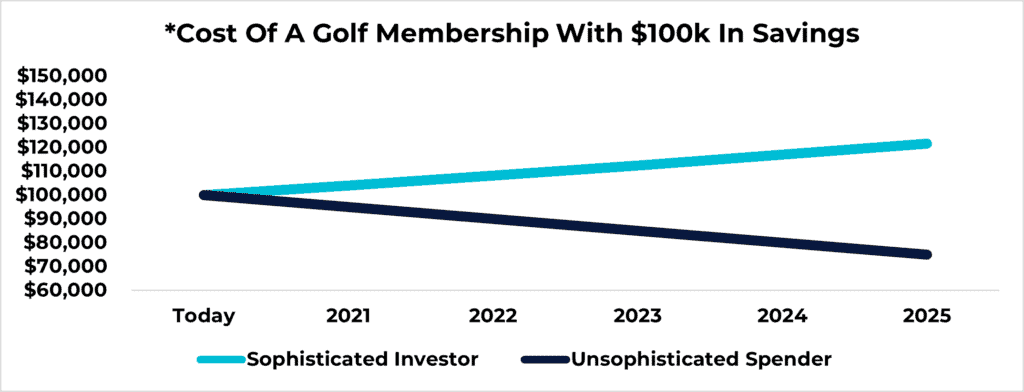

*Note: Illustration assumes the sophisticated investor places his/her savings into a 5% yielding private equity real estate investment that averages 4% in equity appreciation each year. The unsophisticated spender withdraws $5,000 each year for their annual dues, depleting their initial savings of $100,000 down to $75,000 over a five-year period.

Surprisingly, the answer is rather simple. Sophisticated investors only make lavish purchases with excess cash produced from their investments. If their investments do pay out enough to cover most of their purchase, a sophisticated investor will delay the commitment until their cash flow levels have increased.

For example, let’s say you desire a new golf member at a private course close to your home. The membership fees are approximately $4,000 annually plus the additional requirements of $1,000 worth of food and beverage consumption each season. Totalling $5,000 for the year in golf expenses.

An unsophisticated spender may look at their savings today and say, I have X, therefore I can afford Y and have Z left over. Whereas a sophisticated investor will look at their savings and determine how much of a potential investment they need to make to get the annual cashflow necessary to make the purchase. The difference in these scenarios is that one individual actively reduces their savings and the other maintains and grows their savings while achieving the material objectives that they desire.

Finding suitable and reliable investments that provide a cashflow (also called yield) can be the key to obtaining whatever joys you desire while maintaining and growing your hard-earned savings.

Bottom line, sophisticated investors make spending decisions based on their investment decisions. Over time, as illustrated in the chart above, the difference can be material.